This article explains in simple terms how small business employers can navigate through complex compliance rules for Fair Labor Standards Act (FLSA) and how good time keeping can help with the compliance.

The following, at the minimum, should be taken into account for smooth onboarding:

- Test to make sure that the person is an employee and not a contractor. See below on how classify employees and what the laws are regarding this.

- Mention the employee’s job description in clear terms that will be clear to the employee, any member of management or an external investigation agency (should the need arise).

- Let the employee know the laws regarding the compliance of employee status (as exempt or non-exempt)

- Set up a point of contact for resolving all employee wage issues. Address all the employees’ concerns and grievances quickly and professionally as soon as possible.

-

According to the Federal Labor Standard Act (FLSA) recordkeeping requirement , the employer must keep the following record for each employee:

-

Demographic:

- Full name, address, zip code and social security number

- Birth date

- Sex and occupation

-

Work Related:

- Beginning of service start date

- Which day the week starts

- Hours worked each day and total hours worked each week

- How the employee is paid (For example, $15 per hour or $600)

-

Payroll:

- Total regular and overtime earnings each week

- All deductions (or additions) from the employee’s wages

- Total wages paid each pay period

- Date of payment and the pay period

-

Demographic:

- Preserve all the payroll records for at least 3 years.

According to the DOL timekeeping policy , any timekeeping system is acceptable as long as it gives complete and accurate information. The following are some of the important points:

- The timekeeping policy should be written down and distributed to all the employees.

- Management should make sure that each employee understands and remembers the policy.

- Many companies rounds the time to the nearest 15 minutes (or 5 minutes) to ensure that the rounding is done correctly and employees are not at a disadvantage for rounding errors.

- Keep the timekeeping information for at least 3 years. Note that some states require more than this (for example New York requires six years).

-

Keep an accurate record of the following:

- Work Schedules and In/Out times (if applicable)

- Time-Off requests and approvals

- Absence without leave

- Overtime

- Timesheet approvals

- Project deadline and budgets

- Keep a record of all the communication with employees in case of non-compliance with the timesheet policy like not submitting timesheet on time, unannounced absences, incorrect time entry, etc.

- It is a good idea to have the employee sign the timesheet. For digital timesheets, they can be certified (with their password) to attest to the timesheet. One of our customers, uses our free timesheet template to take a print copy and have the employee sign and scan it.

In addition to the DOL labor compliance, employers will need to comply with the state’s law. Employees’ always get the maximum advantage of these two laws. For example in California:

- The policy for rounding of time is nearest to 15 minutes or less. However, the emmployer must provide a 30-minute meal break for employees, which cannot be rounded.

- Paper or ink document can be also be used for timesheet.

You, as an employer, should contact the state agency to get more information for your state.

-

Hourly Employees:

- They need to record the Start time, End time, overtime and breaks accurately.

- FLSA allows for rounding off the recorded time at 15 minutes or less.

- Employers can modify employee’s timesheet without their knowledge as long as it is accurate.

-

Salaried Employees:

- Employees get a fixed amount per month.

- Employees can take leaves set according to the company policy.

- If the employee takes a leave for one and one-half days, the employer may deduct salary for the one full day of absence, but the employee must receive full pay for the partial day worked.

There are two types of people working for your company or project: Employees and Contractors. Employees in turn can be classified as Exempt or Non-Exempt Employees.

Employees or Consultants

This classification is important because an employer must withhold taxes (Social Security and Medicare) for Employees. Consultants are independent business persons who have contractual relationship with the company and they are responsible to pay their taxes.

Employers often makes mistake in classifying them correctly. Individual state laws in the United States make this more complicated. Internal Revenue Services (IRS) has designated how to classify between employees and consultants. In simple terms, the following may be pointing to an employee:

- If the business can control (it does not matter whether the business exercises the control) the worker’s place and time of work.

- If the business provides training or detailed instruction for work.

- If the ongoing work is evaluated regularly then the work may be an employee. However, if only the result is evaluated then it points to the consultant.

- Is the worker using significant resources from the employer (like equipment, office space, etc.)?

- Is the worker paid in regular intervals or the worker has a lot of unreimbursed expenses?

- The written contract between the worker and employer is not very clear.

- Worker is provided benefits like health insurance, allowances etc.

- How much of the worker’s service is key factor in running the business.

Exempt or Non-exempt Employees

In short Non-Exempt employees are eligible for overtime when they work more than 40 hours a week. Exempt employees mostly do executive and administrative management and do not receive any overtime. Exempt employees receives bonuses and other perks from the company. As of Jan 1, 2020, workers who do not earn at least $684 per week should be paid overtime.

There are federal and state laws governing the classification of the employee’s exempt status. These laws changes very often, here we will attempt to provide the most recent information and provide reference to the up-to-date information in this regard:

-

Minimum Wage:

-

Federal minimum wage (as of Jan 2021):

- The federal minimum wage is $7.25 per hour.

- For young employees (age less than 20 years), it is $4.25 per hour for the first 90 calendar days. Then it is $7.25 per hour.

- Service industry employees who receives tips needs to be paid only $2.13 per hour. However, if this amount and the tip do not equal the federal minimum wage, then the employer must make up the rest of the amount.

-

State Laws:

A state may have its own minimum wage law that is different from the federal minimum wage. If the state minimum wage is different from the federal minimum wage, the employee must receive the higher wage of the two.

-

Federal minimum wage (as of Jan 2021):

-

Overtime:

Federal laws require non-exempt employees who work more than 40 hours should get overtime at least 150% of the regular pay.

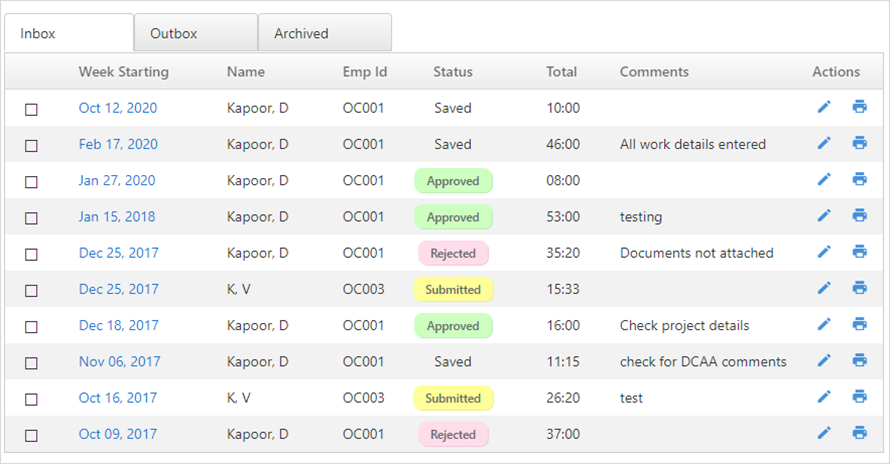

- With a digital timekeeping system, the accuracy rate of recording the correct time is high as compared to traditional timekeeping methods. With traditional timekeeping methods, there were chances of employees filling up the time inaccurately or making frauds. A digital timekeeping system will eliminate inaccuracies and will be error-free.

- With paperless timekeeping, employees can record time through the desktop or their mobile phones. They don’t have to be in the office to fill up the timesheets anymore.

- The automated timekeeping process ensures that all the tracked time data and the time-offs taken by employees are in one place. With all the required records in hand, the payroll process becomes faster and smooth.

- With timesheet management, it becomes easy to keep track of projects, and their tasks, allocate them to the respective users and track time for each allocated task.

- If an employee forgets to fill up the timesheet or submit a timesheet, the automated timekeeping system will send notifications to fill up or submit the timesheets on time.

- Overall the digital timekeeping process will smoothen your attendance process, save time and help focus on more important jobs and responsibilities, improvise the payroll process and increase productivity.

- Information is saved on-line in a sql database. It is easy to retrieve information selectively in case of investigation.

- DCAA compliance can be enabled for additional tracking of timesheet and entry practices.

- Ability to do edit checks helps compliance.

- Customized reports shows pattern of time keep for employees and any absences.

- Ability to approve timesheet by supervisor avoids inadverent mistakes.