“All employees of Government Contractors must comply with the DCAA (Defense Contract Audit Agency) regulations and Federal Accounting Regulations (FAR). Failure to comply with such rules may result in penalties and lose government contracts”

In this article, get a deeper understanding about DCAA Compliance – A guide for Government Contractors.

1. What is DCAA?

2. What is DCAA Compliance?

3. DCAA Audits: What you need to know?

4. What should be the DCAA compliance criteria?

5. What happens when contractors do not comply with the DCAA regulations?

6. What are the guidelines for DCAA timekeeping requirements?

7. How OfficeClip Timesheet helps you stay DCAA compliant?

What is DCAA?

The Defense Contract Audit Agency (DCAA) is an independent agency within the Department of Defense (DoD) that provides audit and financial advisory services to DoD and other federal entities.

DCAA audits the financial records of contractors who receive DoD contracts to ensure that they are using taxpayer funds appropriately. DCAA also provides guidance and assistance to contractors on how to comply with DoD financial regulations.

The DCAA is under the authority, direction, and control of the Under Secretary of Defense (Comptroller)/Chief Financial Officer.

The DCAA conducts a wide range of audits, including:

- Cost audits: These audits determine the reasonableness of costs charged to DoD contracts.

- Compliance audits: These audits ensure that contractors are complying with DoD regulations.

- Financial statement audits: These audits provide an independent opinion on the fairness of a contractor’s financial statements.

- Performance audits: These audits evaluate the effectiveness of a contractor’s operations.

You can take a look at more information: DCAA Audits.

What is DCAA Compliance?

DCAA compliance is the process of following the DCAA recommendations and guidelines to remain compliant with federal law regarding government contracts. DCAA audits are driven by the rules outlined in FAR, CAS and GAGAS.

For timekeeping and accounting DCAA requirements need to be implemented in the organization to ensure prevention of fraudulent billing to the government. This means that the submitted timesheets become legal documents of the company and they must be accurate and complete with properly maintained accounting records.

The primary area of emphasis includes:

- Internal control systems

- Management policies

- Accuracy and reasonableness of cost representations

- Adequacy and reliability of records and accounting systems

- Financial capability

- Contractor compliance with contractual provisions having accounting or economic significance such as the cost principles

Timesheet is an important part of DCAA compliance because information generated from timesheets is also used for payroll, billing, project planning, cost accounting and pricing purposes.

Streamline Employee Timekeeping with OfficeClip Timesheet Software!

DCAA Audits: What you need to know

- DCAA audits are conducted in accordance with generally accepted government auditing standards (GAGAS).

- GAGAS are a set of professional standards that govern the conduct of audits by independent auditors.

- DCAA audits are designed to provide reasonable assurance that contractor financial records are accurate and that contractor costs are allowable, allocable, and reasonable.

- DCAA has set up a goal of doing unannounced floor checks yearly (and sometimes as often as twice a year) at the government contractor site or the vendor work site. To comply with these audits, various guidelines are provided by the DCAA.

- During these checks, DCAA may talk to the employees and look at whether the timesheets are completed daily (and not done backdated or in the future).

- If there is a change made to the timesheet, they will like to see the reason for the change.

- There are also other contractor specific audits that may occur either in the proposal stage (generally for fixed-price contracts) or in project execution stage (for variable price contracts and Time and Labor contracts).

- These audits may cover accounting procedures, adequacy of the accounting systems etc.

- The DCAA’s audits can result in a number of findings, including:

- Overpayments to contractors

- Unallowable costs

- Mismanagement

- Fraud

- The DCAA’s findings are communicated to the DoD and to the contractors involved. The DoD and the contractors are then responsible for taking action to correct any problems identified by the DCAA.

The DCAA plays an important role in ensuring that the DoD receives the best possible value for its taxpayer dollars. By conducting audits of contractors, DCAA helps to protect the interests of the DoD and the American taxpayer.

More information on DCAA Real Time Labor Evaluations .

What should be the DCAA Compliance Criteria?

According to research done by Microsoft, no silver bullet solution guarantees compliance with the DCAA. Instead, contractors need to:

- Invest in proper procedures that follow DCAA and FAR guidelines.

- A well-designed procedure is more important than buying an expensive system that claims to do most of the things for you.

- DCAA does not mandate the use of any timekeeping system for compliance.

- Paper-based or Excel-based timesheets are equally good as long as they comply with the guidelines.

- The only problem with paper-based or Excel-based timesheets is that they are difficult to maintain and become more expensive in the long run.

What happens when Contractors don’t comply with the DCAA regulations?

There are several consequences for non-compliance with DCAA regulations which includes:

- Civil penalties: The amount of penaltly will depend on the severity of the violation. Civil penalties can sometimes be as high as three times the government’s loss.

- Criminal penalties: are imposed for cases involving fraud or intentional misrepresentation. Criminal penalties can include fines, imprisonment, or both.

- Debarment: means that the contractor is prohibited from doing business with the government for a period of time or even permanently.

- Voided or terminated contracts: In some cases, non-compliance with DCAA regulations can result in the government voiding or terminating a contract leading to a damaged organizational reputation. This can happen if the contractor has committed fraud, misrepresentation, or other serious violations.

What are the guidelines for DCAA Timekeeping requirements?

Following are the general guidelines for an accurate time tracking system to comply with the DCAA audits:

Create a clear and concise timekeeping policy document:

The formal document should outline the following regulations and guidelines. The policy should be easy to understand and should be distributed to all supervisors and employees.

Ensure that all supervisors and employees are familiar with the policy:

During audits, supervisors and employees may be asked to explain the guidelines they follow to test their knowledge of the policy. Employees should also be kept informed of any changes to the policy.

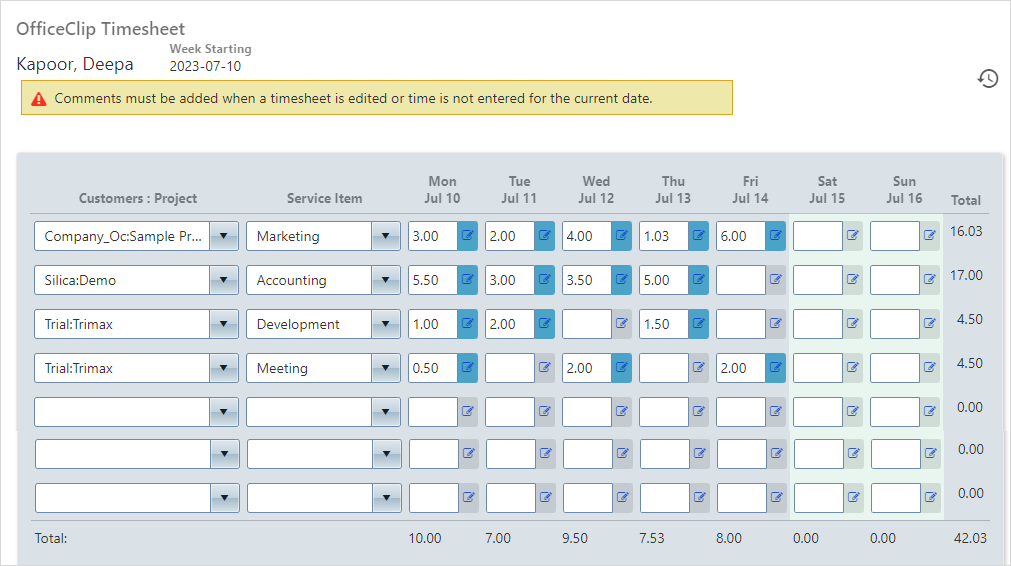

Timesheet must be filled in each day:

To ensure compliance with DCAA regulations, all work hours must be filled in and saved by the end of each working day. Managers can also generate reports of all time recorded.

Any change in already saved timesheet should also contain a reason:

When an employee changes their recorded time, they should be prompted to enter a reason code. This reason code will be recorded in the timekeeping history.

Clearly defined procedures and instructions for accurately recording work hours:

The DCAA mandates that organizations have clearly defined procedures and instructions for accurately recording regular and overtime hours. These procedures should include checks and balances to catch mistakes and fraudulent time entries.

Employees should only record time on assigned projects:

Organizations are responsible for assigning work items to employees and ensuring that they only bill time for work that is related to their assigned tasks.

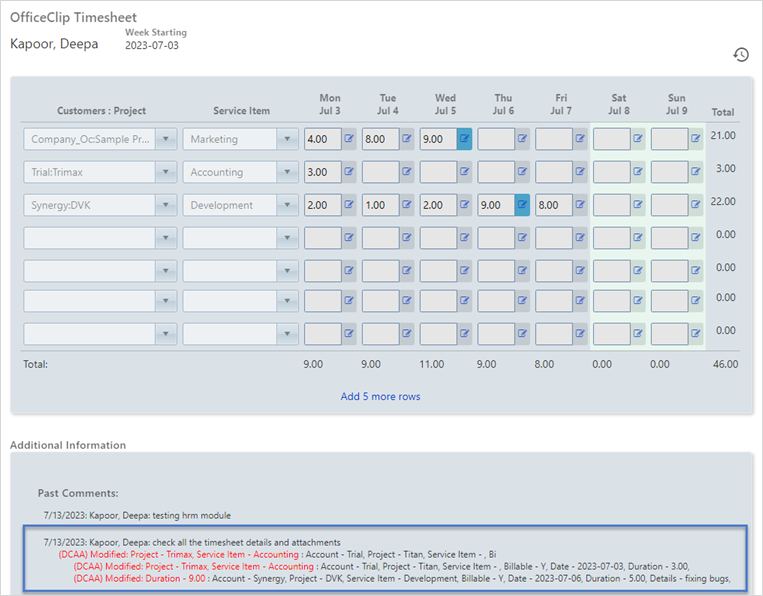

The supervisor must approve all timesheet and log all changes:

When DCAA mode is enabled, all changes to the timesheet are logged. The log includes the previous value (before the change) and the new value (after the change).

Ability to create reports for auditor and managers:

An auditor can view the history of all changes made to the timesheet. The system should be able to generate reports on employee timesheets to ensure that they are completed in a timely manner.

All timesheet must be signed (manually or electronically) and a trail is kept:

In an adequately audited electronic system, a signature is equivalent to a user signing into the system using their password and the system storing all events in a non-editable format. Timesheets can also be printed out and physically signed by the supervisor if necessary.

Supplemental documents must be saved and can be produced to the auditors:

The system should allow users to scan and store additional documents along with the timesheet for future reference.

How OfficeClip Timesheet helps you stay DCAA compliant?

One of the critical aspects for the auditors is to get the information they need at their fingertips. Using a timekeeping system like OfficeClip Timesheet allows compliance in the following way:

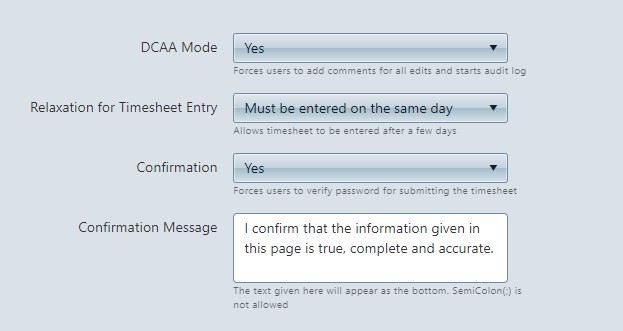

Recording time every day:

The DCAA option in OfficeClip Timesheet ensures that time is recorded on a daily basis. Managers can also generate reports of all time recorded, even though timesheets are submitted for approval weekly.

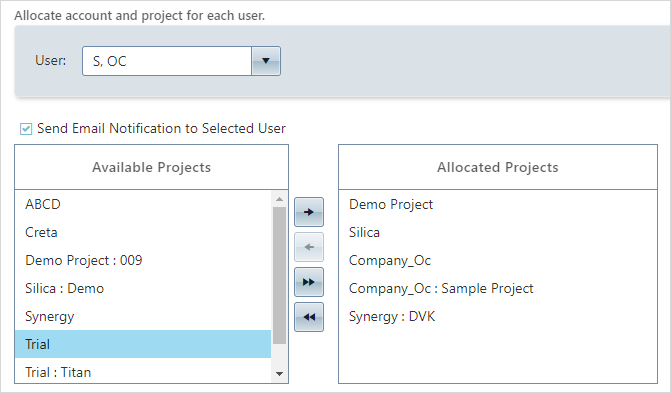

Allocation of Projects:

OfficeClip allows for systematic allocation of projects, so that users only see the projects they are allocated to when entering time.

Accountability for Changes:

When an employee changes the recorded time, they should be prompted to enter a reason code. This reason code will be recorded in the timekeeping history.

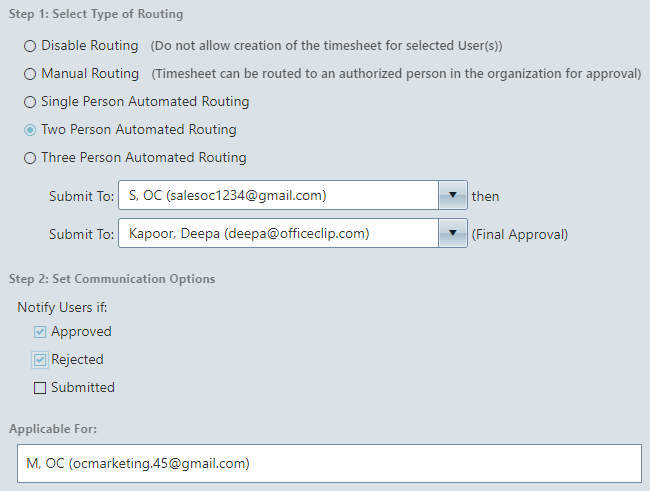

Timesheet Approval:

OfficeClip Timesheet allows you to set up a workflow for approving timesheets. It records all the timesheet approvals and rejections done by the supervisor. You can also set up multiple approval paths, so that the supervisor and accounting department can both approve timesheets.

View the history of changes:

When DCAA mode is enabled, all changes to the timesheet are logged.

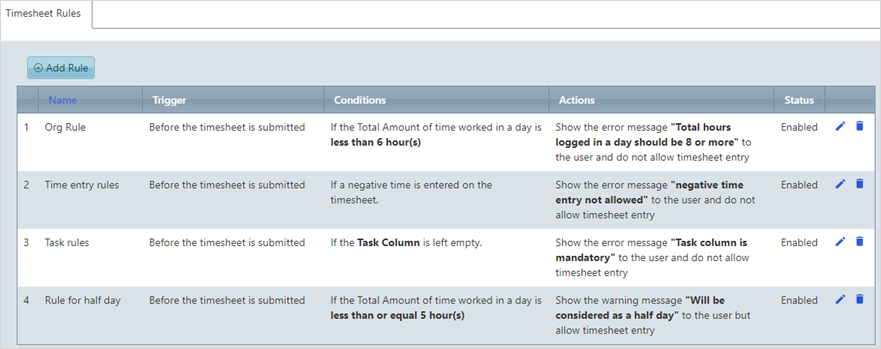

Rules:

OfficeClip allows you to set up rules for edit checks, so that users get a warning before submitting a timesheet in case of non-compliance.

Audit Reports:

OfficeClip Timesheet has various reports, including one specific audit report, that provides auditors with up-to-date status of the timesheet.

Accurate Charging time against charge code:

Each employee can only see the charge codes they are supposed to bill. It reduces some inadvertent billing against incorrect charge codes.

Notifications:

Users will receive automatic reminders for timesheet completion at the end of the day.

Attaching Documents:

With OfficeClip employees can scan and store documents for future reference.

Note: The DCAA Compliance feature is only available in the Enterprise edition of the timesheet.