Gone are the days of scattered client information across spreadsheets and inboxes. A modern CRM (Customer Relationship Management) system acts as a central hub, securely storing all your client data – from contact details and tax documents to communication history.

This keeps all your client info in one place so your team can find what they need quickly and communicate with clients smoothly.

In recent years, many accounting firms have started using online software to manage the enormous amount of client information they handle. This include easy access to tax returns, customer communications, invoicing, automation etc.

In this article, we will cover how your accounting firm can benefit by using a CRM application to make your practice more profitable.

Table of Contents:

- Benefits of using a CRM for Accounting firms

- Purpose of a CRM software for Accountants

- How accounting firms are using CRM?

- How to select the right CRM software for your firm?

- How OfficeClip will help the accounting firms?

Benefits of using CRM for Accountants and CPA’s:

Imagine relying on sticky notes for deadlines and scattered spreadsheets for client information. Scrambling to recall past conversations or hunt for documents wastes time and creates frustration.

This chaos can damage client relationships and hurt your bottom line. Missed follow-ups with potential clients mean lost opportunities.

A CRM is your solution. It eliminates the mess, keeping all your client data organized and readily available.

9 reasons why Accounting firms need a CRM tool:

CRM software can help many businesses, and is not only related to marketing or sales.

Specially, it is very useful for accountants or CPA’s to keep track of their business or clients. How does it helps?

1. Get a 360-degree view of your clients:

Imagine having all your client information – notes, emails, documents, tasks, and everything else – in one central location. With a CRM, that’s exactly what you get.

You and your team can access this information anytime you need to work with that customer. If the client history is readily available your teams will be well aware of their tasks and continue collaborating minimizing the time discussing about client updates.

2. Organize documents and find everything you need in one click:

A CRM is also like a filing cabinet for your clients’ tax-related documents, financial statements, bills, audits, etc., which are organized and stored securely and are also easy to find.

When you open a customer’s history, you can easily find the notes and documents attached. This feature empowers you with a comprehensive view of your client’s interactions, allowing you to stay in control of the relationship.

Most CRMs have powerful search features that make it easy to retrieve documents.

3. Improved Customer Service:

A CRM empowers your firm to deliver exceptional customer service and build stronger client relationships. By centralizing all client interactions within the system (emails, calls, notes), your team has a complete view of communication history and current needs.

This fosters consistent communication, allowing for faster response times to client inquiries. Additionally, the CRM’s automation features enable proactive updates on project progress and deadlines, keeping clients informed and valued.

This focus on consistent, timely communication not only strengthens trust but also significantly enhances client satisfaction, ultimately contributing to the success of your practice.

4. Manage Prospects:

A CRM isn’t just about managing existing clients. It can also be a powerful tool for attracting new ones. The CRM helps you:

- Identify and target ideal clients: Analyze lead data to find potential clients who are a good fit for your firm.

- Streamline lead follow-up: The CRM automates follow-up tasks and keeps track of all communication (emails, calls), making it easy to nurture leads through the sales process.

- Close more deals: By staying organized and proactive with potential clients, you increase your chances of converting them into paying customers and growing your business.

5. Automation:

Your employees may continuously work on some recurring tasks daily. Like sending newsletters, updates, reminders, doing follow-ups, or generating reports daily.

A CRM can automate most tasks, saving your teams important time and allowing them to focus on more critical tasks like financial planning, providing strategic advice, or attracting new clients.

6. Integrations:

Modern CRMs don’t work in isolation. They seamlessly integrate with the tools you already use, like:

- Email Marketing Platforms: Easily design and send targeted email campaigns to clients or prospects.

- Payroll and Accounting Software: Eliminate double data entry by automatically syncing client information, payroll, and financial data.

- Form Builders: Create custom forms for intake, surveys, lead capture, or client portals directly within your CRM.

- Payment Gateways: You can send invoices and receive payments electronically within the CRM platform through available payment gateways. This eliminates the need for manual invoicing and chasing down payments.

These integrations eliminate manual data entry and create a smooth workflow.

7. Secure Data Storage:

When it comes to your client’s financial information, security is paramount. A CRM takes data protection seriously. Here’s how:

- Secure Storage: Your client data is encrypted and stored on secure servers, protecting it from unauthorized access.

- Access Controls: You control who has access to client information, with different permission levels for your team members.

- Data Backup and Recovery: Robust backup systems ensure your data is safe even in case of unexpected events.

With a CRM, you can rest assured that your client data is in good hands.

8. Self-Service Portal:

Managing hundreds of clients can be time-consuming. A CRM with a customer portal empowers your clients by giving them secure, 24/7 access to:

- Securely access important documents: Share invoices, tax documents, and other files with your clients through a secure online portal. This eliminates the need for emailing sensitive information and gives clients easy access to the information they need.

- Streamline communication: Clients can easily access important information, ask questions, raise queries, and upload documents directly through the portal. This fosters better communication and collaboration.

This self-service approach frees up your team’s time and allows clients to access information on their own schedule. It fosters a sense of transparency and builds trust in your firm.

9. Boosts Productivity:

Nowadays, CRM tools are available with many advanced features such as automation, powerful reports, and custom fields. Imagine a new customer receiving automated offers or regular updates on tax details or laws once you save them in the system.

In addition, the system eliminates many manual tasks and can set up automated emails to remind customers of document submissions.

This saves a lot of time and effort, as employees can focus more on important tasks and complete them within a given time frame. The CRM software will help your team be more organized and accountable, ensuring they work smarter and not harder, translating to increased productivity and a happy client base.

What is the primary purpose of CRM software for Accountants?

How other accounting firms are using CRM?

-

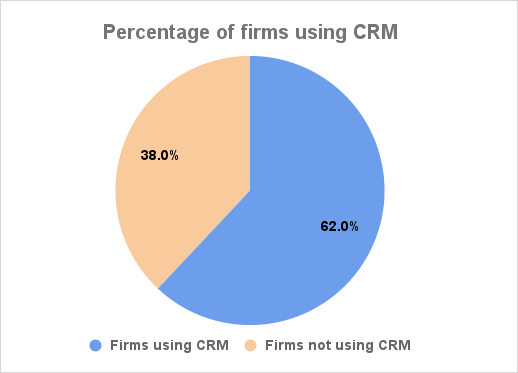

Accounting Firms using CRM:

The above chart shows that 60% and above accounting firms are using or have used a CRM. On the other hand, people not using CRM are comparatively on the lower side.

-

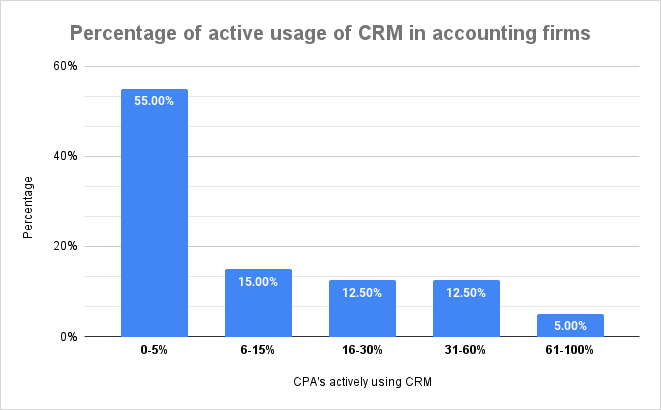

Active usage of CRM in accounting firms:

The above survey shows that 55% of respondents mentioned that 0-5% of CPAs at their accounting firm actively use CRM. On the other hand, only 5% of respondents said that more than 60% of their accountants actively use CRM at their firms.

-

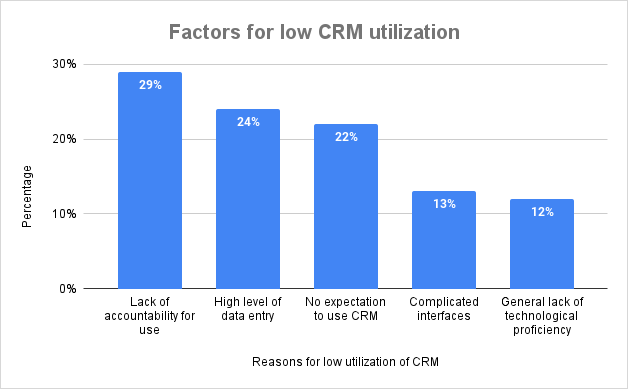

Factors that contribute to low utilization of CRM:

-

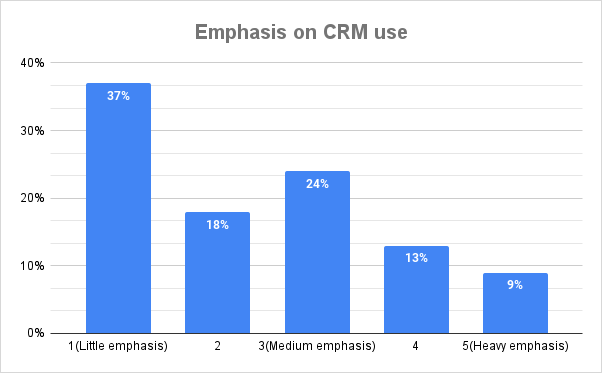

Emphasis on CRM use:

Over 37% of respondents mentioned that there was little or no pressure on accountants to use CRM, while only 9% of respondents mentioned that there was heavy pressure on them to utilize CRM tools.

How do you select the right CRM for your accounting firms?

1. Pricing:

A CRM system starts from around $3 per user per month for small businesses. However, most advanced packages for larger enterprises range from $50 to $150 per user per month, while few expensive CRM systems charge $300 per user per month or more. The pricing varies depending on features and user count. Be realistic about your budget and identify features that are essential for your firm and then take a decision.

2. Ease of Use:

Look for a CRM with a user-friendly interface that minimizes training time and ensures smooth adoption by your team.

3. Support:

Reliable customer support is crucial. Opt for a CRM with readily available support options, such as documentation, tutorials, or even live chat functionalities.

4. Deployment Options:

Cloud-based (SaaS) CRMs are popular for their accessibility and ease of use. If internet connectivity is a concern, explore on-premise solutions. Find more detailed information on different types of software suites and their pros and cons.

5. Scalability:

Consider your growth plans. Choose a CRM that can adapt to your needs as your firm expands.

6. Number of Users:

Ensure the CRM can accommodate your current and future team size.

7. Implementation Time:

Opt for a CRM with a smooth and efficient implementation process to minimize disruption to your workflow.

8. Device Compatibility:

Choose a CRM accessible across various devices (desktop, mobile) for on-the-go access.

9. Regular Updates:

Regular updates ensure security, bug fixes, and access to new features.

10. Team Collaboration:

Look for features that facilitate seamless communication and task coordination within your team.

11. Return on Investment (ROI):

While ROI can be difficult to quantify directly, consider factors like increased productivity, improved client satisfaction, and potential revenue growth.

12. Integration:

Does the CRM integrate with your existing accounting software, payroll systems, or email marketing platforms?

13. Automation:

Can the CRM automate repetitive tasks like sending reminders, emails, generating reports, or following up with clients?

14. Reporting Capabilities:

Does the CRM offer robust reporting tools to gain insights into client activity, project progress, and key performance indicators (KPIs)?

Additional Tips:

- Free trials: Many CRMs offer free trials. Utilize these to test-drive the software and ensure it meets your expectations.

- User reviews: Read online reviews by other accounting firms to gain insights into user experience and common pain points.

- Industry-specific options: Consider CRMs designed specifically for the accounting industry. These may offer tailored features and integrations relevant to your needs.

By carefully evaluating these factors, you can select a CRM that empowers your accounting firm to thrive.

If you find difficulty taking a decision on choosing the right CRM software, use our Decision Matrix template. This template will help you make the right choice.

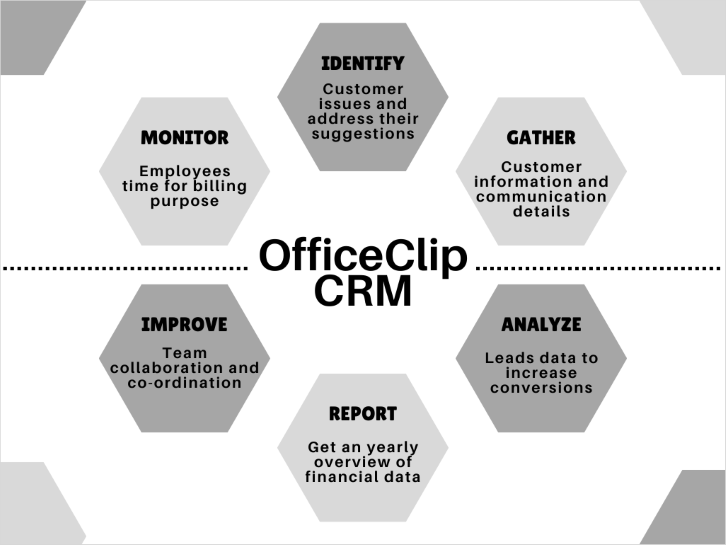

How OfficeClip CRM will help the accounting firms?

-

Document management:

Document management can be a challenge for accountants and CPAs who have to deal with many documents like taxes, accounting statements, audits, financial year planning, etc. Maintaining and retrieving these documents whenever required can be difficult.

OfficeClip document management can help you store all your documents in one place in multiple folders. These documents can be shared, copied, and quickly retrieved whenever needed. Your clients can also upload documents directly to the system without needing to send attachments or PDFs via email.

-

DropSite:

DropSite is another feature where your customers can upload all their tax documents like 1099s, receipts, etc., inside the OfficeClip document manager.

-

Centralized Customer Information:

OfficeClip CRM stores all your client’s data in one place. This data includes their personal information, business information, documents, notes, tasks, events, emails, issues, etc.

This information can also be imported and exported in CSV format. While dealing with clients, your team members can easily track past interactions, documents, emails, and notes for reference.

-

Integration:

The integration feature provides an additional benefit in accounting firms. OfficeClip provides integration with Quickbooks and ADP payroll system which will help to sync your data directly from the timesheets.

-

Follow-ups with clients:

Every client needs a follow-up regularly. You will have to get in touch with your leads at specific intervals. Remembering to call your clients at different intervals is a challenging task.

OfficeClip Call list feature will allow you to create a call list for your clients and leads. Every day you can get a list of due follow-ups daily. This call list will help you stay connected with your clients and keep in touch with your leads.

-

Billing and Invoicing:

Billing and invoicing are essential for accounting firms who need to bill their clients or send quotes to prospects. Our CRM software has built-in invoicing so that you can easily manage billing and invoicing tasks.

-

Time management:

Managing and keeping track of time spent on tasks for clients is very crucial for accountants and CPAs. For example, it is important to keep track of the time taken for audits, preparing tax documents, statements, etc.

OfficeClip timesheet can help you track the time taken for each client and their tasks. This time tracking for your teams will help in accurate billing for your clients, additionally it will also help to estimate time for similar future projects.

-

Reports:

OfficeClip report management can help you analyze all the monthly or yearly financial data. These reports will help in better planning and estimation of future financial transactions.

-

Customer Portal:

Accountants and their clients need to share all the tax details and financial statements and exchange documents with each other. OfficeClip customer portal is a secure portal where clients can view all the documents shared with them, add their queries or issues, and upload documents if required.

Conclusion:

Before adopting a CRM software for accountants find out which tool suits your needs best, and how it will simplify your workflow, and fulfill all your business requirements.

Try the OfficeClip CRM Free trial today with unlimited users, and it will definitely prove to be the best CRM for your accounting firm.

Photo Courtesy:

The data source for Charts:

Note: This blog was published in 2021 and has been updated.

Deepa Kapoor is an online writer for small businesses. She loves to write on the advancements of new technologies and how it affects our lives. She always explores ways to make small businesses more profitable. When not writing, she enjoys reading books and cooking exotic traditional food.